Welcome To IIP Learning Hub

IIP Learning Hub is an authoritative reference designed to help both new and existing advisers:

Understand our professional expectations around ethics, record‑keeping, client engagement and continuous improvement

Navigate daily compliance obligations under the IIP licence and the broader AFSL framework.

Leverage our technology stack to drive efficiency and quality.

Access templates, processes and support quickly, so you can focus more time on serving clients.

Meet your instructors

✳

Meet your instructors ✳

SARA

IIP’s AI Compliance Assistant

FINLEY

IIP’s Brand Ambassador

-

Chapter 1 - An Intro to IIP

-

Lesson 1: Welcome to Insight Investment Partners

Introducing Insight Investment Partners, Our Mission, Values, Compliance Culture and Key Contacts.

-

Lesson 2: Your Authorised Rep Responsibilities

An overview of the professional and ethical framework we operate in and details the practical application of that frameworks.

-

Lesson 3: The Onboarding Process

We are excited to have you onboard.

Let’s take a look at the background checks and steps for joining IIP as an Authorised Rep.

-

Lesson 4: Accessing Your FSG

Now you are Authorised, let’s look at how you can access your FSG to provide to your clients.

-

Lesson 5: Accessing Support

Feeling a bit lost and need some help? Let’s go through what actions you can take to ensure you can get the support you need from our subject matter experts.

-

-

Chapter 2 - Setting Up Your Advice Process

-

Lesson 1: Setting Up Project Templates

How to set up your advice process using the projects app

-

Lesson 2: Configuring The Xplan Integration

Maintaining 2 CRM’s is a headache.

So we have integrated iComply2 with Xplan, so you can maintain your client records in one CRM.

Connecting to Xplan is simple.

-

Lesson 3: Starting a New Project

Starting kicking goals with Projects.

In this guide, we will go through the steps involved to kick off a new Project using iC2 Projects App..

-

Lesson 4: Adding A Shared User

Today, business is global. Connecting should be easy.

In this guide, we will go through the steps involved to Adding a Shared User to your iC2 Environment. You can connect and work with anybody.

-

Lesson 5: Creating A Paraplanning Request

Do you have an SOA for our paraplanning service?

Follow this guide to assign the SOA to Camela.

-

-

Chapter 3 - The Advice Process and Documentation

-

Lesson 1: Navigating the Advice Process

The provision of personal financial advice in Australia is governed by a robust regulatory framework.

Here’s an overview of the Key Steps in the Advice Process.

-

Lesson 2: Engagement Letter

Providing financial advice begins with clarity—and that starts with an engagement letter.

Here’s why this simple document plays a crucial role in every client–adviser relationship. -

Lesson 3: Understand the Review Process

Understand what constitutes a client review and the documentation requirements

-

Lesson 4: Secure Document Storage

Effective client file management is essential to demonstrating professionalism, regulatory adherence, and a commitment to acting in clients’ best interests

-

-

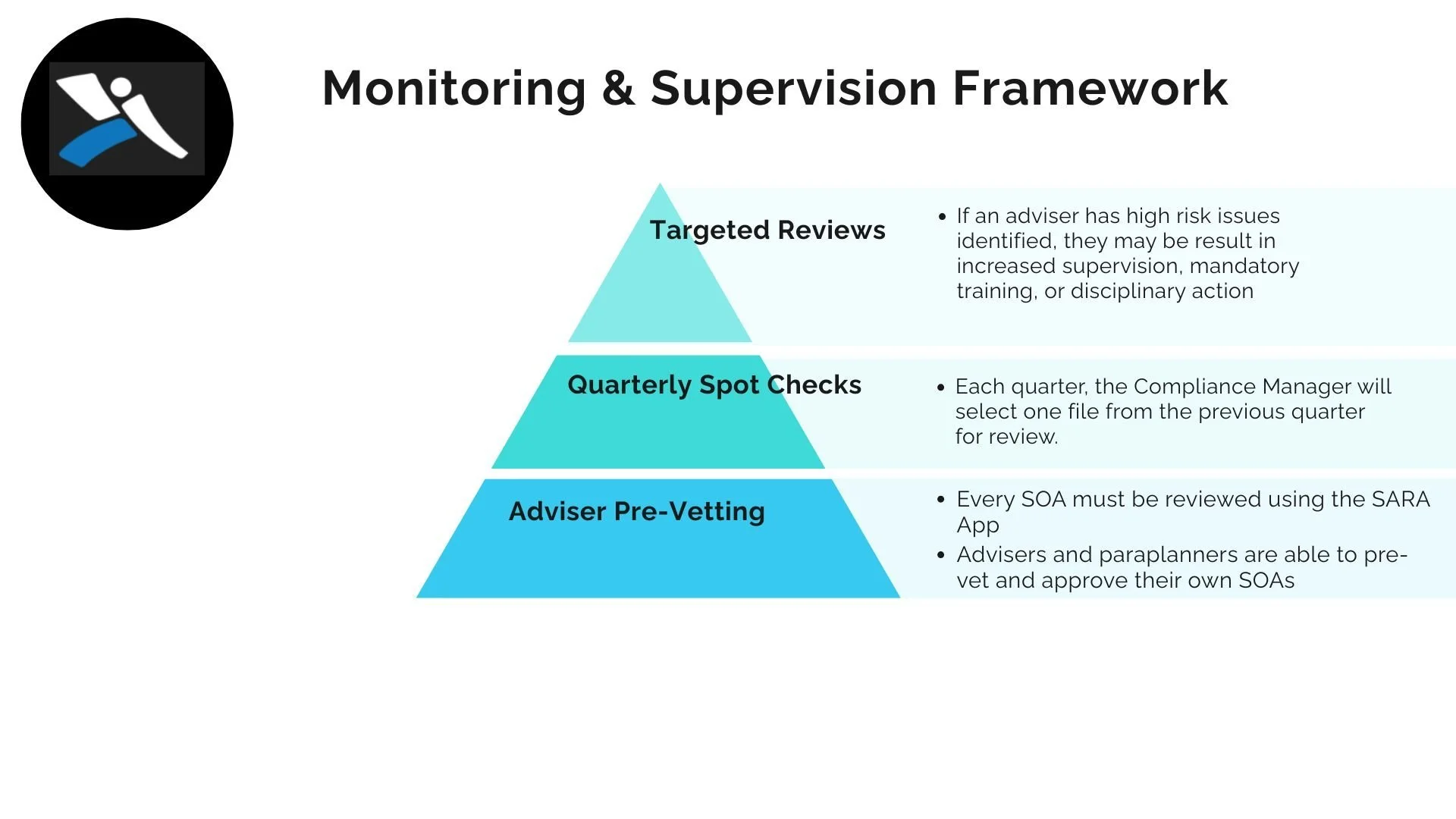

Chapter 4 - The Monitoring and Supervision Framework

-

Lesson 1: The IIP Monitoring and Supervision Framework

Our aim is to establish a robust framework for the provision of financial advice.

This ensures consistent delivery of high-quality financial advice.

-

Lesson 2: Preparing For Your FiIe Review

Adequately preparing for your review will ensure a smooth review experience.

Here’s an overview of the File Review Process

-

Lesson 3: Reviewing the Draft Findings

Your compliance manager has made a draft report of the initial findings

You can review the findings in raise any disputes or concerns before the report is finalised

-

Lesson 4: Remediating The File

Your file review has been finalised

Let’s take a look at how you can action any observations made by the file reviewer

-

-

Chapter 5 - Providing SMSF Advice

-

Lesson 1: Understanding SMSF Advice

SMSFs can provide flexibility and control, but they also carry higher risk and responsibility. This lesson highlights the key considerations advisers must assess before recommending an SMSF, focusing on suitability, risk, and regulatory expectations.

-

Lesson 2: SMSFs Property and Referral Networks

SMSF strategies involving property and referral networks carry heightened regulatory and client risk. This lesson outlines ASIC’s concerns and explains why advisers retain full responsibility for property‑driven SMSF recommendations.

-

-

Chapter 6 - The Compliance Hub

-

Lesson 1 - Accessing Advice Policies

You can access all our AFSL Advice Policies from the Advice Policy Register in the iC2 Compliance Hub

-

Lesson 2 - Access Document Templates

Templates, templates, templates.

All the advice templates you need to provide compliant advice to your clients.

-

Lesson 3 - Reporting an Incident or Breach

Sometimes, things go wrong.

When running a financial advice business, it is expected that breaches and incidents will occur.

Nobody is perfect and breaches and incidents will happen.

-

Lesson 4 - Client Complaints

All complaints must be handled in accordance with the Licensee processes.

Before resolving any complaints, report the complaint and refer to the complaints handling process.

-

Lesson 5 - Non-Cash Benefits

Have you received a non-cash benefit?

In this guide, we will go through the steps involved to log a non-cash benefit with IIP.

-

Lesson 6 - APL Requests

Do you want a product added to the APL?

Using the iC2 Compliance Hub, you can request one off, or general approval for new product.

-

Lesson 7 - Sophisticated Investor Certificates

Store Sophisticated Investors Certificates in the SPI Register.

In this guide, we will go through the steps involved to add a Sophisticated Investor Certificate to the register

-

-

Chapter 7 - SARA

-

Chapter 8 - Entering Fee Agreements

-

Lesson 1 - Ongoing Fee Agreements

This lesson sets out the Licensee’s standard for entering into and maintaining Ongoing Fee Arrangements (OFA).

Test your knowledge of OFA’s

-

Lesson 2: The OFA Renewal Process

Consent To Renewal

Renewal can be done within the period starting 60 days before the Reference Date and ending 150 days after the Reference Date.

-

Lesson 3 - Fixed Term Fee Agreements

This lesson sets out the Licensee’s standard for entering into and maintaining Fixed Term Fee Arrangements (FTA)

-

-

Chapter 9 - DBFO Tranche 1

-

Lesson 1 - Website Disclosure Information

Website Disclosure Information gives advisers the flexibility to decide how they disclose information to clients that is otherwise required to be in an FSG

-

Lesson 2 - OFA & Consent

As part of the Delivering Better Financial Outcomes (DBFO) Package, the Albanese government has made amendments to the obligations relating to ongoing fee arrangements and consents.

-

Lesson 3 - Informed Insurance Consent

From the 9th July 2025, advisers that receive commissions as part of the issue or sale of life insurance to a retail client in personal advice situations must obtain informed consent.

-

-

Chapter 10 - Revenue Management

-

Lesson 1 - Fee Collection

Understand our fee collection process.

What fee types can i charge, and how can i collect the fees from my clients.

-

Lesson 2 - Raising an Invoice

Licensee Invoice systems can be clunky..

The challenge has been that there are too many moving parts

The invoicing and accounting is done in Xero, the client CRM is Xplan (or similar), the revenue management is done by Revex….

But all these systems don’t talk…..

-

Lesson 3 - Setting Up Direct Debits

Set Up Direct Debits For Your Fee Agreements

Let’s take a step by step look at how to create direct debits in iC2 Revenue using the Ezidebit payment solution

-

Lesson 4 - Adviser Pay Runs

Let’s Get To The Good Stuff.. How Do You Get Paid?

We have created a dedicated portal for managing adviser pay runs.

-

Lesson 5 - Processing Client Fee Rebates

Need to process a rebate to a client?

Complete the Client Rebate Authority and send through to support

-

-

Chapter 11 - Cyber Security

-

Lesson 1 - The Importance of Cyber Security

Cyber security isn’t just an IT problem — it’s a core business risk for every financial-advice practice.

As custodians of sensitive client data and regulated financial transactions, advisers must understand how even a small lapse can create large-scale harm.

-

Lesson 2 - Common Cyber Threats Facing Advisers

What are you up against every day?

The key attack vectors criminals use to steal money or data from advice businesses

-

Lesson 3: Practical Ways To Protect Yourself

Learn the basics.

It’s easy to improve your cybersecurity! Take these simple steps today to protect yourself.

-

Lesson 4 - Responding to a Suspected Cyber Incident

Golden Rule: Speed, structure, and transparency.

The longer an incident goes uncontained, the higher the financial, legal and reputational cost. -

Lesson 6 - Obtaining Cyber Insurance Cover

We are in the process of obtaining group wide cyber cover. Watch this space as we finalise the policy

-

-

Chapter 12 - Technology Support

What you’ll learn

-

An overview of the professional and ethical framework

-

How does

-

Describe your lesson with a short summary.