Our aim is to establish a robust framework for the provision of finance advice.

This ensures:

Consistent delivery of high-quality financial advice.

Compliance with all relevant regulatory requirements.

Protection of Insight Investment Partners' reputation.

Continuous improvement in advice processes and client outcomes.

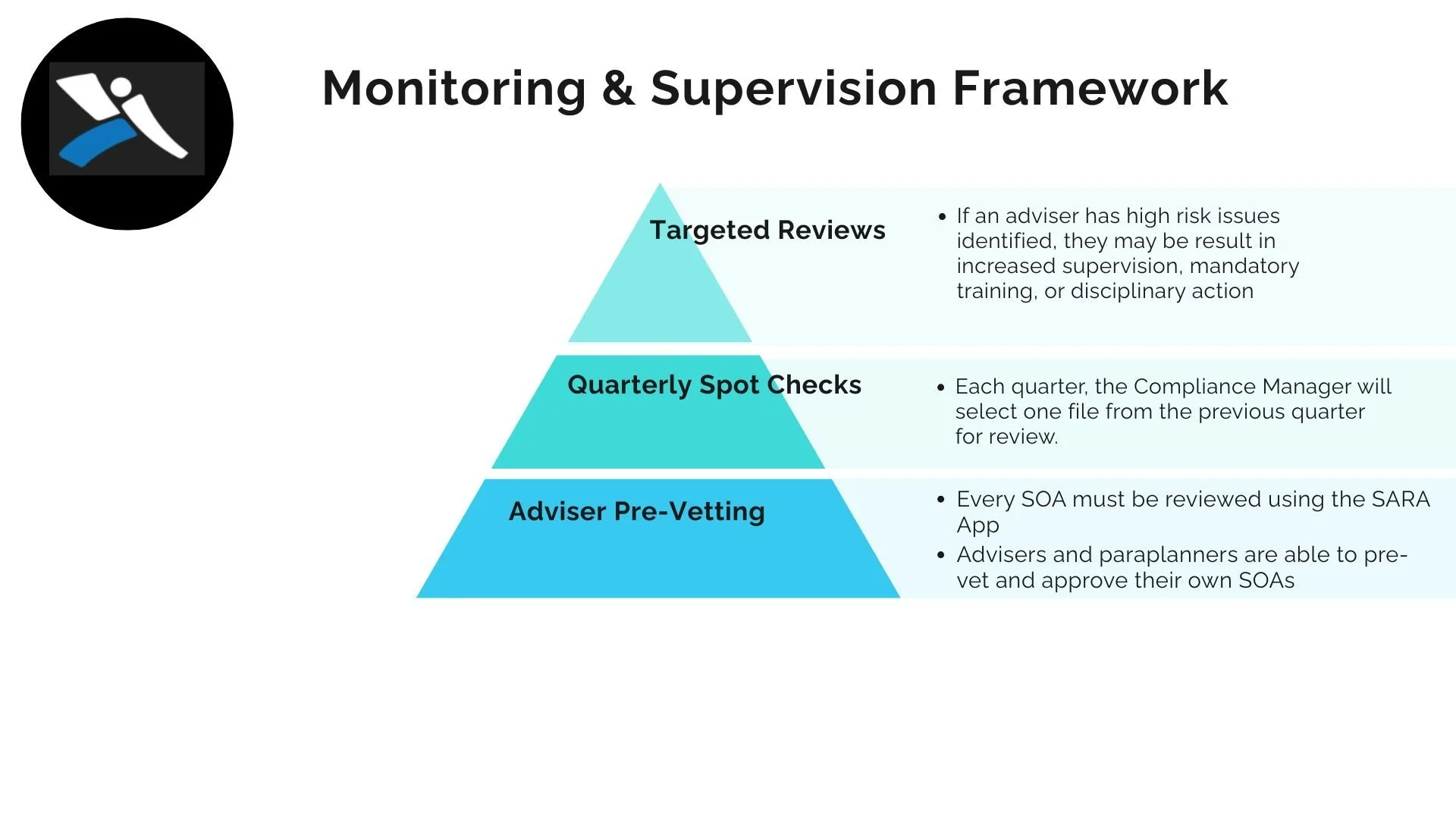

Tier 1: Statement of Advice (SOA) Pre-vetting

Mandatory SARA App Review: Every SOA must be reviewed using the SARA App (https://icomply2app.com.au/sara).

Self-Assessment: Advisers and paraplanners are able to pre-vet and approve their own SOAs via the SARA App.

Issue Escalation:

If the SARA App identifies any compliance issues, these must be documented.

Advisers/paraplanners must forward these issues to the Compliance Manager immediately.

The Compliance Manager will review the issues and provide guidance on any remediation required.

For instructions on how to send an SOA to SARA for pre-vetting, follow the Adviser Pre-Vetting Guide on the button below

Tier 2: Quarterly Spot Checks

Selection of Files:

Each quarter, the Compliance Manager will select one file from the previous quarter for review.

The selection aims to cover a range of advice types and identify any emerging risks.

The Review Process:

The Compliance Manager will follow the established Compliance File Review procedure (see Section 5).

The review focuses on adherence to regulatory requirements, internal policies, and the quality of advice.

Feedback and Remediation:

Findings will be documented, and a report will be provided to the adviser.

If issues are identified, a Remediation Action Summary will be created.

Advisers must address remediation actions within 60 days.

Tier 3: Targeted Reviews

If an adviser has high risk issues identified, they may be result in increased supervision, mandatory training, or disciplinary action.

The adviser may need further Targeted Reviews on specific files.

Repeated Non-Compliance:

Persistent issues may lead to formal performance management or termination.

Compliance File Review Procedure

The Compliance File Review procedure involves a systematic examination of client files to assess compliance and advice quality.

Review Components

Documentation Review:

Previous Compliance Action Plans (if any).

Advice documents (SoA, RoA).

File notes and client communications.

Financial Planning Questionnaires and risk profiles.

Fee disclosures and application forms.

Compliance File Review Procedure

The Compliance File Review procedure involves a systematic examination of client files to assess compliance and advice quality.

Assessment Criteria:

Compliance with legal and regulatory requirements.

Alignment with Insight Investment Partners' policies and procedures.

Evidence of a robust and repeatable advice process.

Review Outcomes:

Scoring and Ratings:

Each file is assessed using a standard checklist with weighted questions.

Issues are rated as Low, Medium, or High risk.

Reporting:

Advisers receive a Compliance Review Report summarising findings.

High-risk issues trigger immediate escalation to the Responsible Manager.

Remediation Actions:

Identified issues must be addressed within specified timeframes.

Failure to remediate may result in performance management actions.

Preparing For Your Review

You can learn more about preparing for your review in Lesson 3: Preparing For Your Review.

Learning More

You can learn more about the Monitoring and Supervision Framework and accessing the policy on the button below: