The provision of personal financial advice in Australia is governed by a robust regulatory framework.

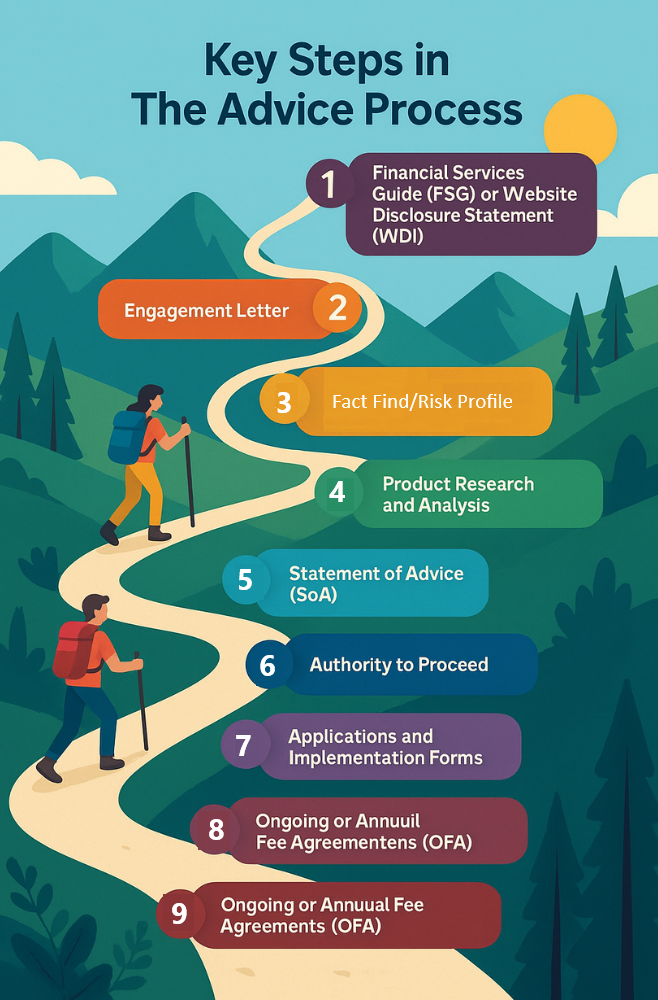

Here’s an overview of the Key Steps in the Advice Process and the key documentation in the advice process and why each is crucial from a compliance perspective

Key Steps in The Advice Process:

1. Financial Services Guide (FSG) or Website Disclosure Statement (WDI)

❓What is an FSG?

The FSG is a disclosure document that provides clients with essential information about the licensee and their authorised representatives.

❓What is a WDI?

Instead of providing your retail client with a physical FSG, you can elect to use Website Disclosure Information. This is the same information as provided in your FSG, but it is prominently displayed on your website. Using a WDI, alleviates your obligation to provide an FSG.

Where you have relied on WDi, you can mark the checklist as Not Applicable.

2. Engagement Letter

❓What is it?

An Engagement Letter formalises the adviser-client relationship and outlines the scope of advice, fees, and responsibilities.

⚖️Why it matters for compliance:

Although not legally required under the Act, it forms a key part of demonstrating informed client consent and agreement to terms of engagement, which is part of Standard 4 of the Code of Ethics It supports compliance with Best Interests Duty (s961B) by clearly documenting what the client is seeking advice on and what the adviser has agreed to provide.

3. Fact Find / Client Data Collection

🔍Facf Find

This step involves gathering comprehensive details about the client’s financial situation, goals, objectives, risk tolerance, and personal circumstances.

⚖️Why it matters for compliance:

The Know Your Client (KYC) requirement under Section 961B(2)(b) mandates advisers to base advice on accurate and complete client information. An incomplete fact find can lead to inappropriate advice and may result in a breach of Best Interests Duty and appropriate advice obligations.

🔐 AML / KYC Obligations

As part of the client onboarding and fact-finding process, advisers must also comply with obligations under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act).

✅ AML Risk Assessment Form

You must complete an AML Risk Assessment for all new clients to assess their money laundering or terrorism financing risk profile.

This includes assessing:

Client type (individual, trust, SMSF, company)

Geographic risk (country of origin or exposure)

Nature and purpose of the financial services

Source of funds and wealth

Expected transactions or account behaviour

The completed AML Risk Assessment must be retained on file.

Risk Profile Questionnaire (RPQ)

❓What is it?

The primary objective is to determine the appropriate asset allocation and investment strategy that aligns with the client's:

Risk tolerance (psychological willingness to accept volatility)

Risk capacity (financial ability to withstand losses)

Investment objectives and timeframe

This ensures that advice is suitable, tailored, and meets the Best Interests Duty under Section 961B of the Corporations Act 2001.

4. Product Research and Analysis

❓What is it?

Product research involves comparing available financial products based on cost, performance, features, and suitability.

⚖️Why it matters for compliance:

Under RG 175.219–RG 175.231, advisers must demonstrate a reasonable basis for advice, which includes thorough product research. This also aligns with s961G, which requires that the advice be appropriate to the client’s needs and that alternative strategies or products have been considered.

5. Statement of Advice (SoA)

❓What is it?

The SoA is a formal advice document that sets out the adviser’s recommendations, how they relate to the client’s goals, and any associated fees and conflicts.

⚖️Why it matters for compliance:

Required under Section 946A, the SoA is the cornerstone of advice disclosure. It evidences compliance with Best Interests Duty, appropriate advice, fee transparency, and conflict of interest disclosure. It must be provided when personal financial product advice is given to a retail client.

6. Authority to Proceed (ATP)

❓What is it?

A signed Authority to Proceed confirms that the client agrees with the recommendations and instructs the adviser to implement them.

⚖️Why it matters for compliance:

This step is critical for ensuring informed consent. From a compliance perspective, it helps demonstrate that the client had adequate time to consider the advice and voluntarily approved its implementation. It supports audit trails and protects against claims of unauthorised transactions.

7. Applications and Implementation Forms

❓What is it?

These include product application forms, superannuation rollover forms, insurance applications, or investment platform forms used to execute the advice.

⚖️ Why it matters for compliance:

Correctly completed and authorised application forms demonstrate accurate implementation of advice and client instruction. They help meet obligations under Section 912A(1)(a), which requires licensees to do all things necessary to ensure financial services are provided efficiently, honestly, and fairly.

8. Ongoing or Annual Fee Agreements (OFA)

❓What is it?

These are formal agreements for ongoing advice services. They must be renewed annually if fees are deducted from a client's product.

⚖️Why it matters for compliance:

From 1 July 2021, under the Financial Sector Reform (Hayne Royal Commission Response No. 2) Act 2021, advisers must obtain Annual Written Consent for ongoing fee arrangements. This is enforced by s962U, s962P–T, and supported by ASIC RG 263. Failure to comply can result in fees being unlawfully deducted and potential licensee breaches.

9. File Notes & Client Correspondence

❓What is it?

Maintain a dated evidence trail of all meetings (in-person or virtual), calls, e-mails, decisions and alternative strategies.

⚖️Why it matters for compliance:

Supports RG 104 record-keeping and future audit reviews.

10. Annual Review & Renewal

❓What is it?

Yearly check-in to confirm goals, product performance and changed circumstances.

⚖️Why it matters for compliance:

Meets 912A requirement for adequate arrangements and Code Standard 6.

Learning More:

You can learn more about navigating the advice process and where you can access the various templates on the button below